Asset Life Cycle Plans

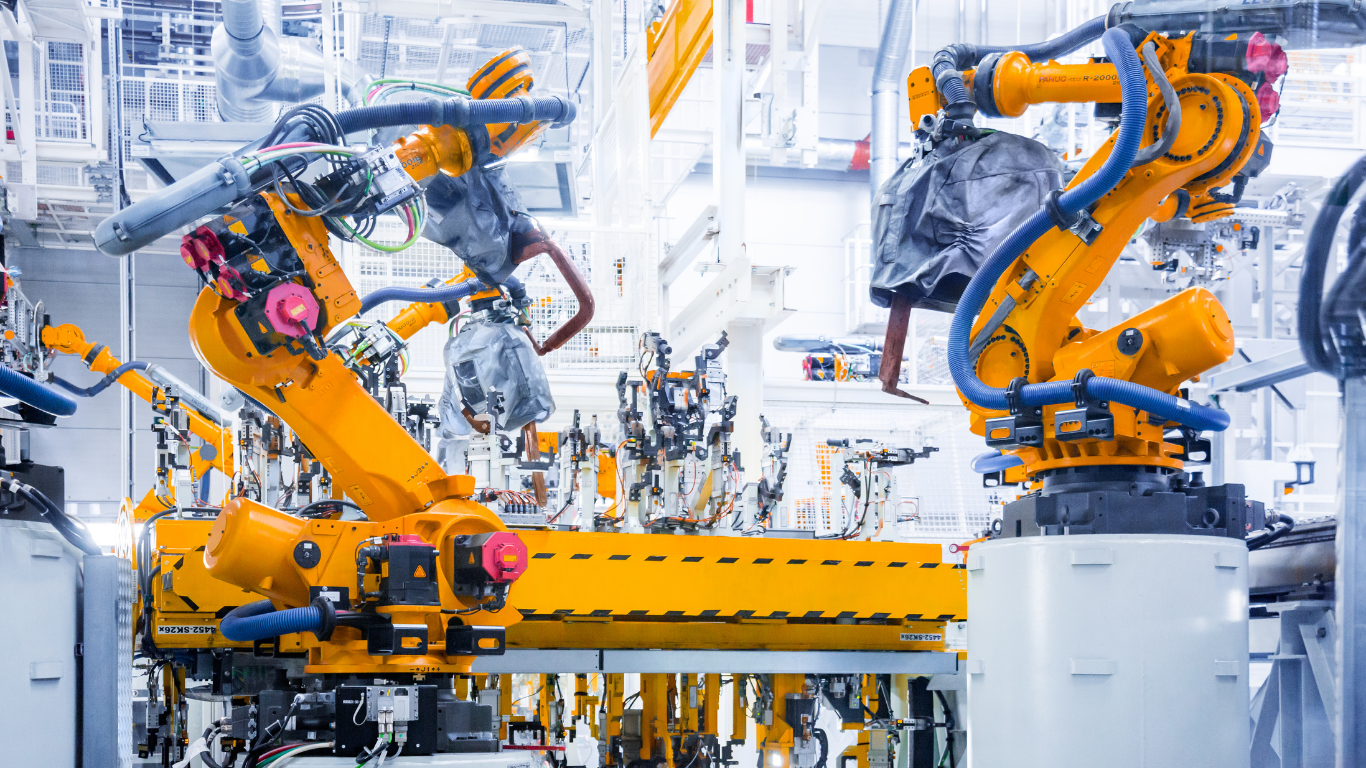

Managing assets effectively throughout their lifecycle is crucial for optimising performance, reducing costs, and ensuring long-term sustainability. At MCP Consulting Group, we provide consultancy services to help organisations develop structured Asset Life Cycle Plans, enabling strategic decision-making and maximising asset value.

PHYSICAL ASSET MANAGEMENT CATEGORIES

What are

Asset Life Cycle Plans

Asset Life Cycle Plans provide a structured approach to managing assets from acquisition through to disposal. These plans ensure that assets are maintained, operated, and replaced efficiently to minimise costs, reduce risks, and extend asset longevity.

At MCP, we help businesses implement tailored life cycle plans that align with ISO 55001 best practices, ensuring sustainable and cost-effective asset management strategies.

Key Objectives of

Asset Life Cycle Plans

1

Optimising Asset Performance

Develop strategies to enhance asset reliability, efficiency, and productivity over its life span.

2

Reducing Total Cost of Ownership

Implement cost-effective maintenance, refurbishment, and renewal strategies to lower lifecycle costs.

3

Supporting Capital Investment Planning

Use data-driven insights to inform asset investment decisions and ensure long-term financial planning.

4

Minimising Risks and Failures

Identify potential risks and failure points to implement proactive maintenance and replacement strategies.

5

Ensuring Compliance with Asset Management Standards

Align asset condition assessments with ISO 55001 requirements and industry best practices.

MCP Approach to

Asset Life Cycle Plans

MCP conducts detailed evaluations of asset performance, condition and projected lifespan to develop future maintenance replacement or refurbishment actions. Our structured approach ensures assets are optimally managed from acquisition to disposal.

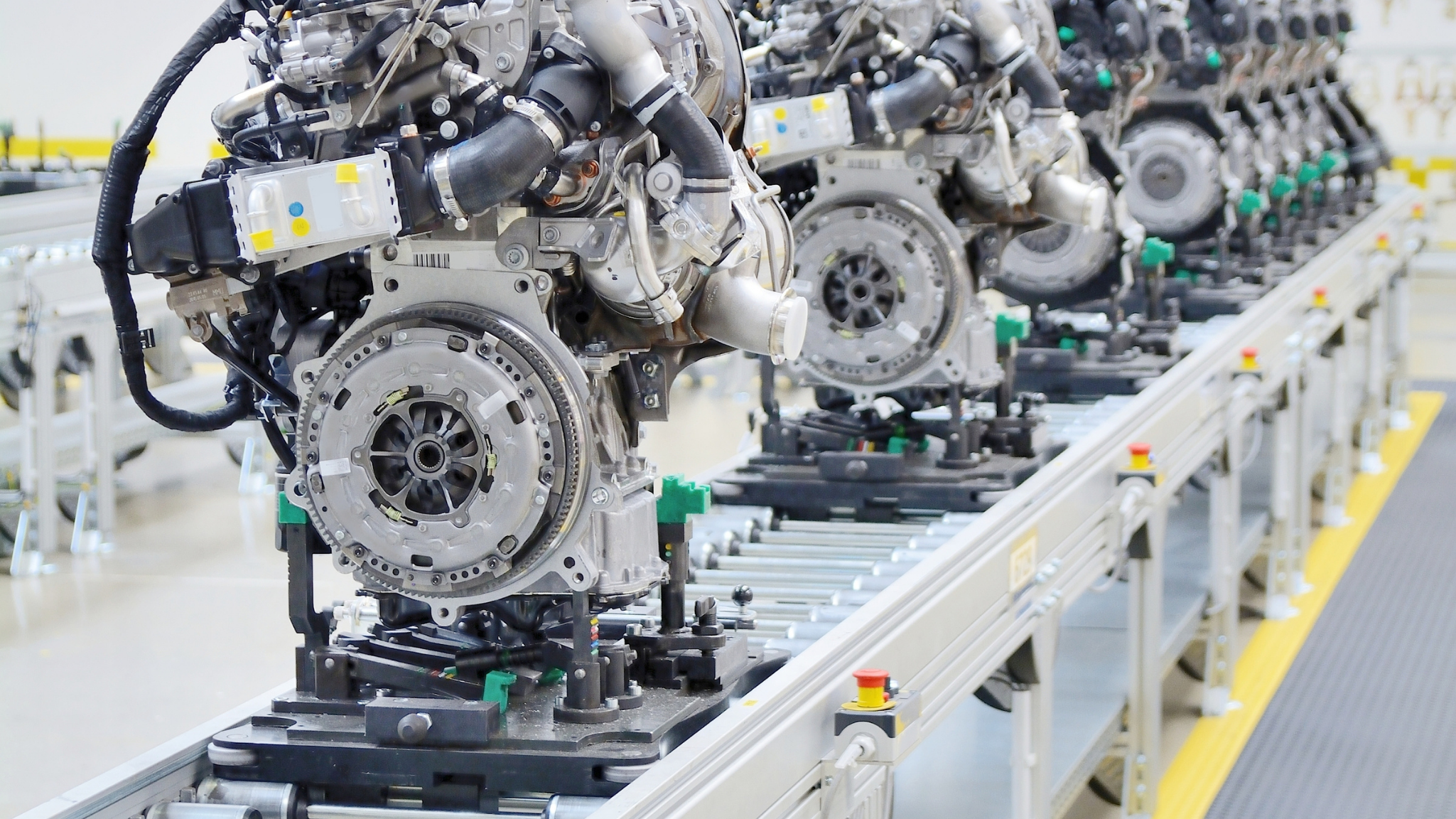

Comprehensive Asset Life Cycle Assessment

Strategic Maintenance and Renewal Planning

We work with organisations to develop structured maintenance, refurbishment, and replacement schedules, ensuring long-term asset reliability and cost efficiency.

Our consultants apply financial modelling, risk assessments, and total cost of ownership (TCO) analysis to help organisations make informed asset investment decisions, reducing unnecessary expenditure and maximising returns.

Financial and Risk-Based Asset Decision Making

We utilise predictive modelling and performance analytics to provide businesses with actionable insights, helping them balance cost, risk, and performance while ensuring compliance with ISO 55001 standards.

Data-Driven Asset Investment Strategies

MCP ensures that asset life cycle plans align with industry regulations, sustainability goals, and best practices, supporting long-term asset governance and environmental responsibility.

Lifecycle-Based Compliance and Sustainability Planning

Physical Asset Management

Explore More

Speak to One of Our

Expert Consultants

If you have any questions or would like to learn more about how MCP Consulting Group can support your organisation with Asset Life Cycle Plans, please get in touch with us. Our team of consultants is ready to provide tailored solutions to enhance your asset management framework and ensure compliance with international standards.

FAQs

-

An Asset Life Cycle Plan provides a structured approach to managing assets from acquisition to disposal, optimising performance, cost efficiency, and risk management.

-

By implementing structured maintenance, renewal, and replacement schedules, businesses can minimise unexpected costs, extend asset lifespan, and improve resource allocation.

-

Industries such as manufacturing, utilities, healthcare, transportation, and facilities management benefit from structured asset lifecycle strategies to ensure long-term operational efficiency.

-

Asset Life Cycle Plans ensure compliance with ISO 55001 by incorporating risk-based decision-making, performance optimisation, and structured governance frameworks.

-

Asset Life Cycle Plans should be reviewed periodically, typically every 1-3 years, to incorporate technological advancements, regulatory changes, and evolving business needs.